Tools Built for Execution, Ignored in Strategy

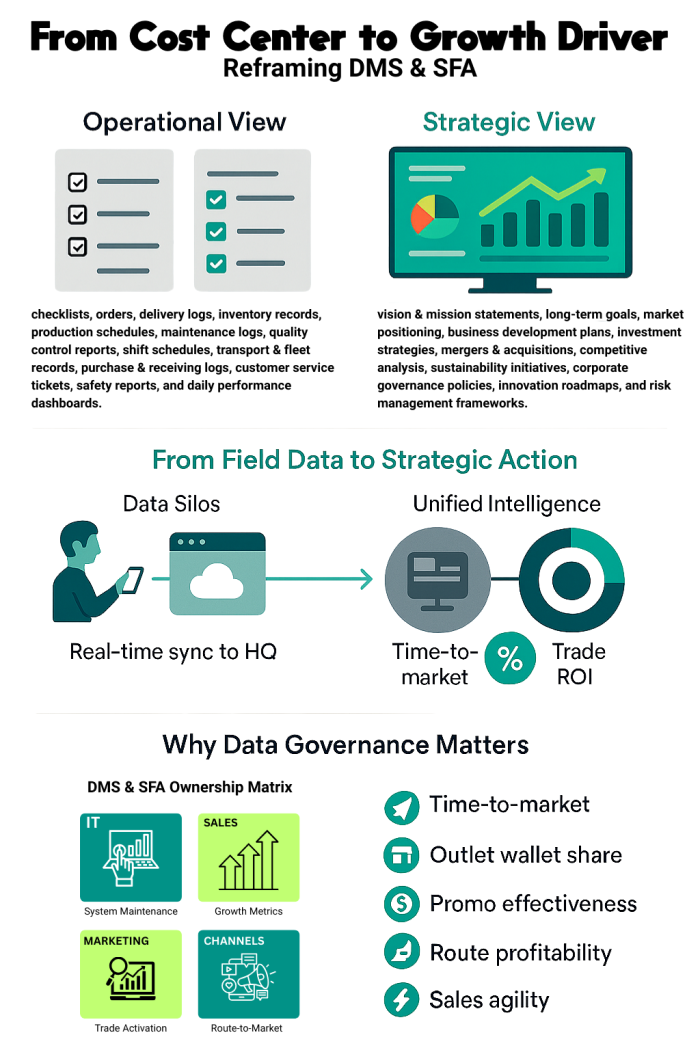

Distribution Management Systems (DMS) and Sales Force Automation (SFA) tools are widely used across FMCG, Pharmacy, and Tobacco sectors. Yet, despite their ubiquity, they are often perceived as mere transactional platforms—useful for recording orders, tracking deliveries, or verifying outlet visits. In many organizations, these systems remain isolated from core strategic decisions. The investment in them is seen as a sunk cost to support operations, not as a lever for competitive advantage.

This narrow perception limits the true potential of these platforms. When DMS and SFA are viewed only through the lens of cost efficiency, their ability to shape execution behavior, drive customer engagement, and power commercial insights gets overlooked.

Misalignment Between Field Tools and Growth Goals

One key reason DMS and SFA are underleveraged is the disconnect between operational teams who use the tools daily and executives who drive long-term growth agendas. While field sales rely on these systems to execute daily tasks, leadership often lacks visibility into how these tools influence behavior, enable agility, or reflect customer needs. As a result, the systems are not optimized for impact—they are optimized for compliance.

Instead of evolving as strategic enablers, these platforms stagnate—failing to support innovation in route‑to‑market models, channel development, or performance management.

Undervalued Data, Underutilized Insights

DMS and SFA platforms are data goldmines. Every transaction, outlet interaction, visit plan, stock movement, and claim record provides valuable insight into customer behavior, market dynamics, and execution gaps. Yet in many organizations, this data remains underutilized. It’s often stuck in disconnected silos, delayed in reporting cycles, or mistrusted due to inconsistent logic.

Without a strong data governance as strategic investment framework and unified performance layer, DMS and SFA fail to contribute meaningfully to commercial strategy—insights that could inform pricing, product launches, and trade investments are lost.

Lack of Ownership Limits Strategic Integration

Another barrier is the lack of clear business ownership. In many cases, IT departments are responsible for system maintenance, while commercial teams are detached from platform evolution. This leads to gaps in accountability: enhancements are delayed, change management is weak, and user adoption remains low.

When no one owns the growth agenda behind these platforms, they become administrative tools rather than commercial engines. To shift this, ownership must move closer to the business—especially sales, marketing, and channel strategy functions.

ROI Conversations Stuck in Operational Metrics

When evaluating DMS and SFA investments, leadership often focuses on operational KPIs like order accuracy, visit compliance, or system uptime. While important, these metrics do not reflect the broader commercial impact that modern platforms can deliver.

What’s often missing from ROI conversations are indicators like faster time‑to‑market, increased share of wallet per outlet, improved trade program effectiveness, or stronger route profitability. Until these strategic outcomes are part of the discussion, the full business case for DMS and SFA will remain weak.

Modern Platforms Enable Agile Execution

The truth is, DMS and SFA—when properly architected—can be powerful enablers of agile execution. They can provide real‑time feedback loops between strategy and the field. They can embed sales enablement strategy, enforce program logic, and surface exceptions. They can empower frontliners with actionable insights, enabling them to sell smarter and serve better.

Unlocking Growth Through Platform Repositioning

To reposition DMS and SFA as growth enablers, organizations must first redefine their purpose. This means aligning platform capabilities with business goals—whether that’s expanding distribution coverage, increasing rep productivity, improving promo ROI, or launching new RTM models.

Next, teams must invest in continuous platform evolution: reconfiguring workflows, integrating modules, and ensuring usability. Finally, data must be democratized—clean, timely, and accessible to all levels of decision‑making.

Conclusion: From Compliance Tools to Commercial Engines

DMS and SFA platforms are only as valuable as the role they’re assigned. If they’re seen as compliance tools, they’ll deliver compliance. If they’re activated as commercial engines, they can unlock new levels of visibility, agility, and growth.

It's time for organizations to rethink their distribution platforms—not as cost centers, but as strategic levers for outperforming the market.